Getting Creative about Early-stage Funding – From IOUs to Side Hustles

Published

In the categories:

- For Startups

We’ve all heard stories about entrepreneurs raising $1 million in seed funding based on an idea sketched out on a napkin. Sounds amazing, but how do you get that funder meeting in the first place? And what happens when your product still needs some fine-tuning and validation? Or what if you’re more focused on social impact than runaway profits? Or if the market itself is still being defined? More often than not, this is the case for early-stage entrepreneurs, especially in the impact space, and it can make securing early stage capital challenging and unpredictable.

The “Pioneer Gap” — a term coined by Monitor-Deloitte and the Acumen Fund in 2012 — describes the lack of funders ready and willing to invest in “pioneering” business models for social change.“Although excited by their novelty, investors are often rattled by these firms’ risk profiles and are unimpressed by their financial returns.” In other words, even with the promise of large-scale impact, it’s difficult to get people to take early risk in an unproven market without proof of concept.

So what’s a founder to do? Get creative about capital.

We recently asked leading entrepreneurs in the impact space — including Taren Stinebrickner-Kauffman (Founder of SumOfUs), Travis Moore (Founder and Executive Director of TechCongress), Morgan DeBaun (Founder and CEO of Blavity), and Alex Wirth (Founder and CEO of Quorum) — about how they got off the ground. What we heard proves that there is no one right way, but there are some common themes.

Travis Moore found that his capital pathway was unpredictable. “I thought I had funding mostly nailed down. I had talked to people on the government team of a large corporation, who said they would seed fund us but then didn’t. I thought I’d have to go three and a half months without a paycheck, but it ended up being more like 10.” In Taren Stinebrickner-Kauffman’s experience, “Breakthroughs felt quite coincidental or accidental at the time. I think it was a case of throwing a lot of spaghetti at the wall and see what sticks.”

Here are some of the approaches that helped them break through and get their projects going.

FOUNDERS, FRIENDS AND FAMILY — Think about loans, favors and IOUs

The Kauffman Foundation surveyed Inc.’s 5000 fastest growing companies in America to learn about their sources of funding. The biggest source? Personal savings, followed by bank loans, credit cards and family. This is common in the traditional startup space, but it’s often less available to entrepreneurs whose families may not have as much access to extra income or networks with those kinds of resources. That’s why New Media Ventures (NMV) is focused on demystifying fundraising and diversifying access to capital.

SIDE HUSTLE — Use income from other sources to sustain yourself and your startup

Many entrepreneurs without direct access to investment capital choose to test their idea while they’re working elsewhere. For Stinebrickner-Kauffman, consulting contracts with aligned organizations such as MoveOn and Oxfam provided the dual benefit of a part-time financial support cushion while also serving as good partners to build out and test her idea. DeBaun started Blavity while working at a tech company. After a year and a half, she had iterated on the product, grown her initial audience and saved as much as she could until she felt Blavity was ready to launch. In both cases, Stinebrickner-Kauffman and DeBaun were able to leverage the intersection of their startup and paid work to expand their networks and get ready for launch.

NETWORK — Establish new relationships with people who can support your startup through financing, advice or meaningful connections

A big part of raising capital is having the right network. For example, Stinebrickner-Kauffman had an existing relationship with someone in an advisory role for SumOfUs, and when she emailed him for advice about fundraising it turned out he was a funder himself. “I would say fundraising is an organizing problem,” Stinebrickner-Kauffman says. “If you know how to organize people, then you actually have all the skills you need to do fundraising. It just feels much more intimidating to people. Network to folks, get them excited, ask them for what you need. All of those are exactly what you do when you’re a field organizer.”

This was also true for Moore. His crowdfunding campaign forced him to reach out to people he wouldn’t necessarily have asked for help. One of his supporters shared the campaign with a prominent Washington Post reporter who then wrote about TechCongress. “When he wrote about it, it was validation,” Moore remembers. “When I sent emails to real funders like Google and Ford, I could say the Post profiled me. And they said ‘This is real. I’ll talk to you.’”

CROWDFUNDING — Scale social support beyond your immediate circle or network through online campaigns.

If your enterprise is more public facing and has a compelling story, crowdfunding can be a very effective path to raising capital. Moore launched an Indiegogo campaign which was both a critical piece of his funding plan and also served as strong validation of market demand. Making money from your network and users, like the MoveOn and Bernie Sanders campaigns’ financing models, is a good opportunity to deepen the engagement of supporters who already love your work. Founders are sometimes reluctant to ask their volunteers and advisors to also give money, but veteran movement entrepreneurs know that you leave money and engagement on the table by not giving people a chance to support your work financially.

Moore recommends using a platform that allows you to update the goal (he reached his before he even executed any of his campaign strategies but was unable to increase the amount) and being very specific about what the money is for. For example, Moore set his campaign up to fund very specific things: an application to an accelerator program, a ticket to New York for the Personal Democracy Forum program and even a laptop cord. Contributors want to know that their money is helping to make an impact.

COMPETITIONS, CHALLENGES, AND MICRO-FUNDING — Find funding opportunities designed to nurture innovation

Competitions are an accessible source of seed and early stage funding, allowing founders to demonstrate proof of concept, finesse their messaging and open doors to larger foundations and investors. Since they’re usually organized by larger institutions, these events also offer an important opportunity to gain exposure and build relationships with influential players. (Our next post explains why it’s important to start building relationships early, even if you’re not ready for big funding or to scale yet.)

Quorum found the most success by fundraising through competitions. In one year, Quorum’s founders entered 26 different competitions, and in 13 of those they were finalists or winners. With free office space, access to talented, unemployed people with free time (students) and $15,000 from winning a series of competitions, the team was able to build a beta version of Quorum. Similarly, TechCongress was awarded a $6,000 grant by one of the Shuttleworth Foundation’s trustees as part of its Flash Grant initiative, which awards micro-grants with no strings attached to social change agents.

If you’re interested in exploring competitions, this startup competition guideand this New York Times business competition list are great resources to begin your research.

ACCELERATORS / INCUBATORS — Think about structured programs to guide your progress and milestones in a supportive environment.

After participating in the Points of Light Institute’s Civic Accelerator, CivicX, Moore highly recommends accelerators as a productive step on the path to raising capital. “It forces you to go through a lean startup process,” he explains. Even though he was the only nonprofit in the cohort, he found it helped him to “learn how to talk to your customers, figure out your value proposition and refine your messaging. It’s both helpful and important.” We’ll also address accelerators and incubators in our next post geared towards startups that are beginning to scale.

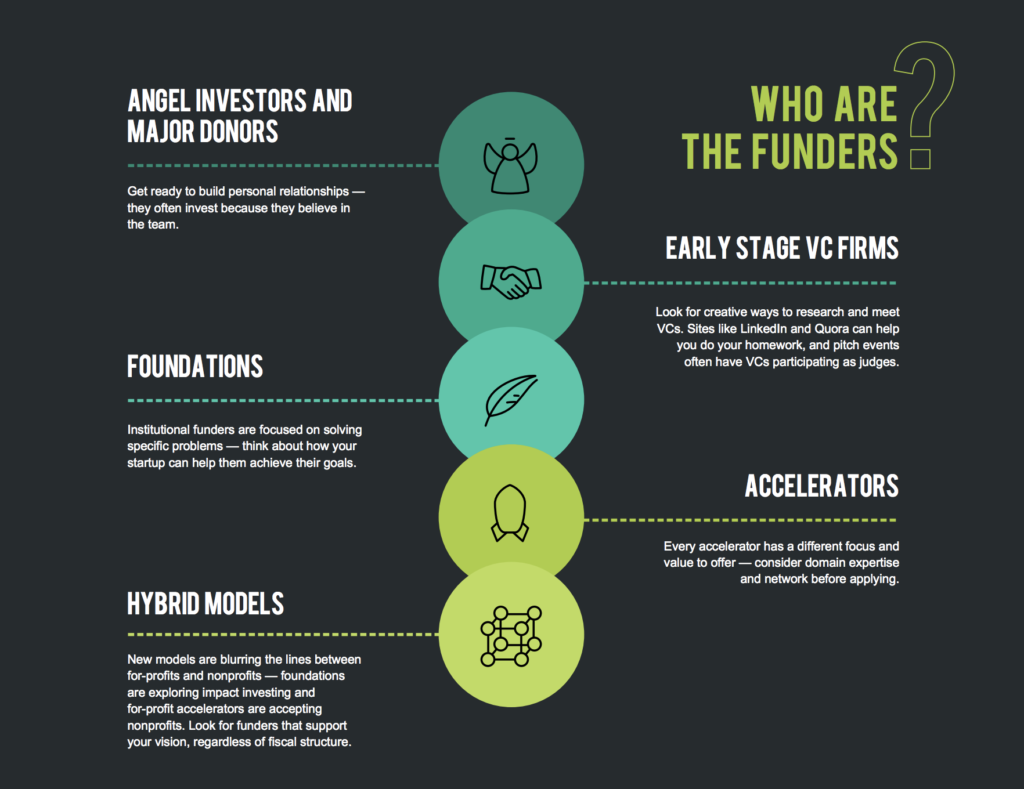

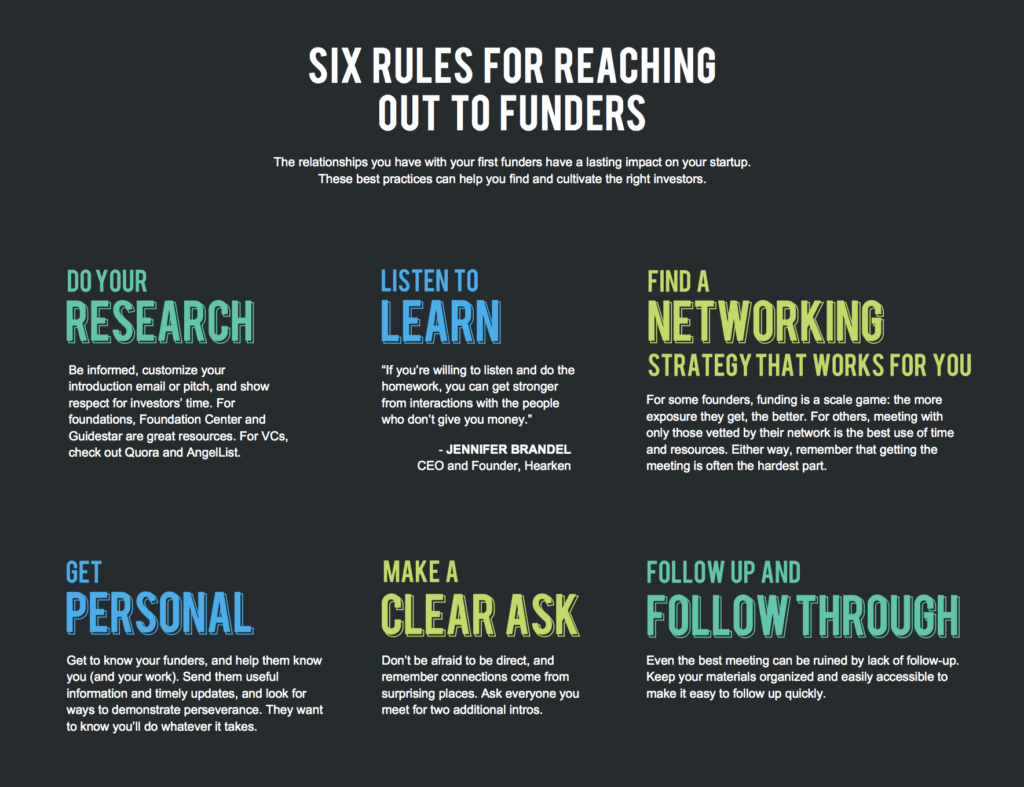

Getting your startup off the ground requires creativity and resourcefulness to get clear about your idea, assemble the right team and demonstrate potential to make an impact. It’s also critical to begin building a network of funders that you’ll have access to when your company is ready to grow and when they’re more likely to invest. Future posts in this series will focus specifically on demystifying who the funders are and what they’re looking for when they’re considering supporting a startup. Fundraising can be an unpredictable path of trial and error, but with a varied, adaptive strategy, resourceful entrepreneurs can find their way.

This is part of a series on fundraising for startup founders focused on impact, and is a collaboration with Shannon Baker, Director of Partnerships at NMV. Let us know if you have questions or more suggestions for resourceful entrepreneurs.